EY offers assurance, audit, tax, financial, and business advisory services to automotive, financial, government, entertainment, mining, real estate, technology, and telecommunication industries.

client

EY

Financial/SaaS

agency

Orion Innovation

Role

Strategy, UI/UX, Design System

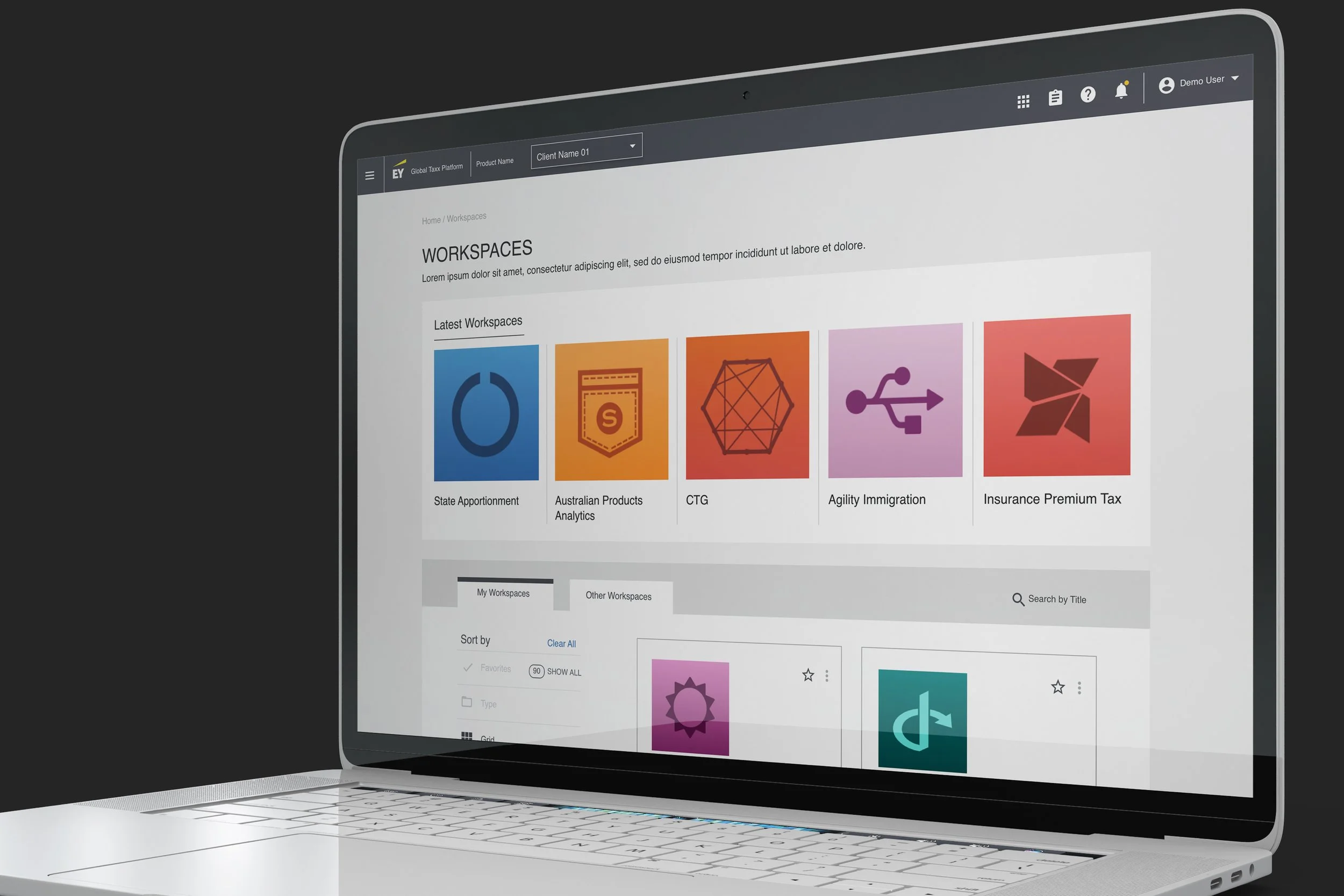

Epic Need: Optimizing the existing EY Global Tax Platform to meet the growing demands and needs of the internal tax preparers for a system to be efficient, effective, and streamlined for their clients.

Problem Statement: The current platform is huge, involves too many layers, steps and the process takes more time than the platform should take in order to prepare taxes.

Consumer tension: Consumers are preferring tax platforms like H&R Block and Jackson Hewitt because they are dynamic, the process of the preparation is faster and efficient.

What MVP tries to solve: An integrated experience that adds value for internal tax prepares, executives overseeing the projects, and cross-connection between EY branches for their daily tasks and establishes a stronger connection for new clients and as well as retention of existing clients.

Solution: A massive size software that encompasses smaller integrated modules (workspaces or apps) that help tax professionals to make their tax work done at ease and smooth. This platform offers both EY Clients and gives them access as Directors reviewing the work and keeping track of the ongoing projects.

Workspaces/Apps:

TIM: Tax Income Module

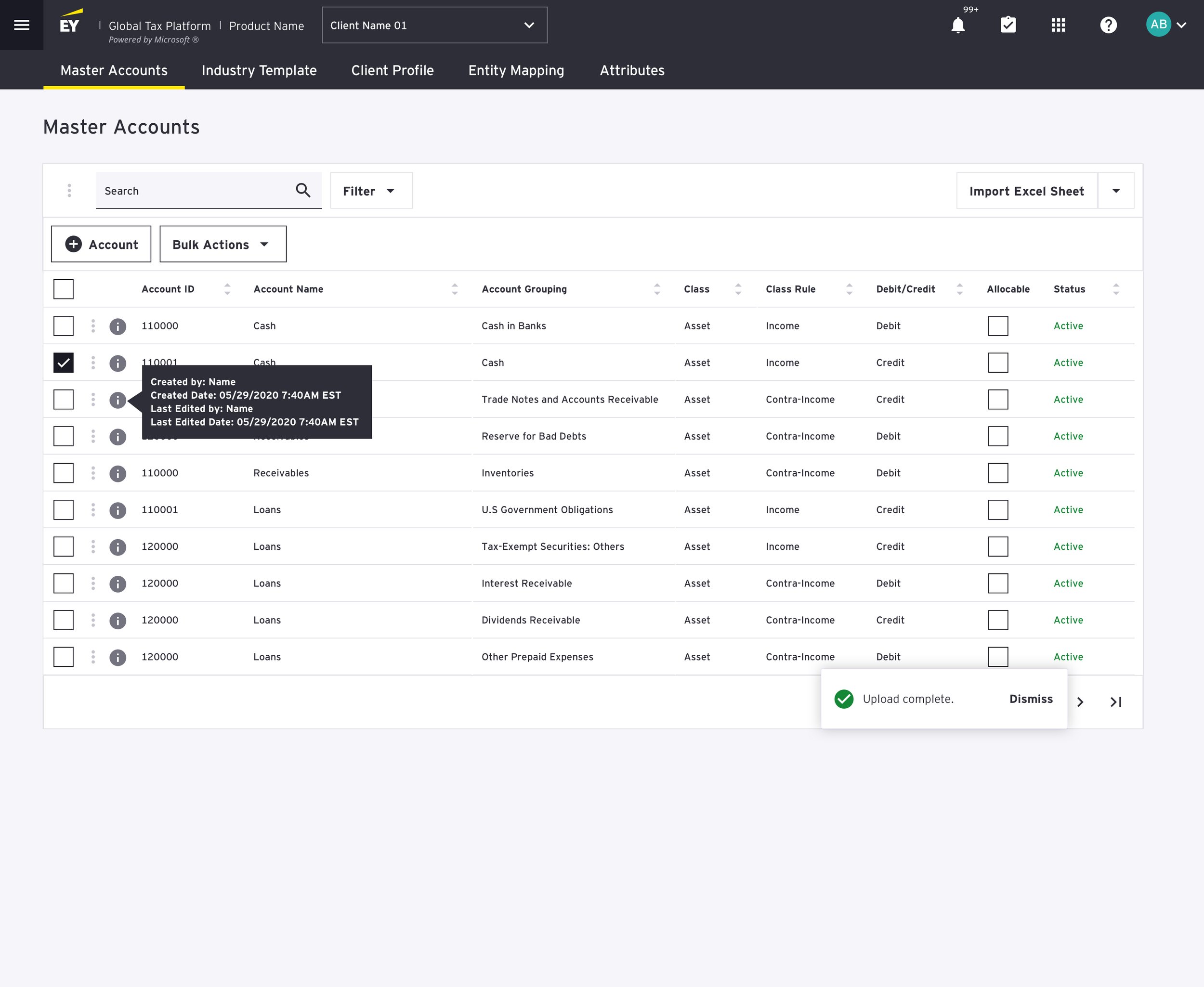

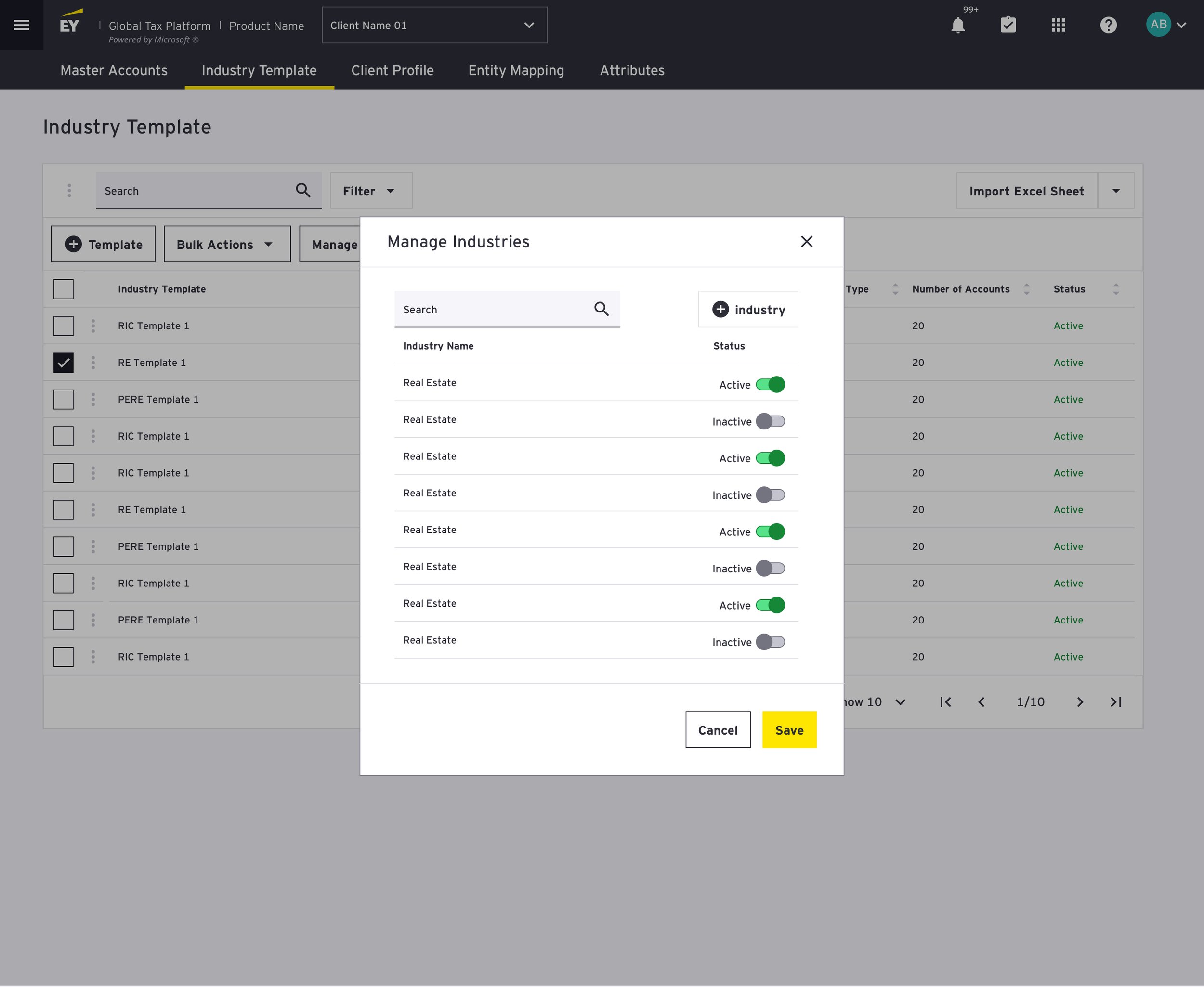

CAM: Charted Accounts Module

RAPToR Experience Map

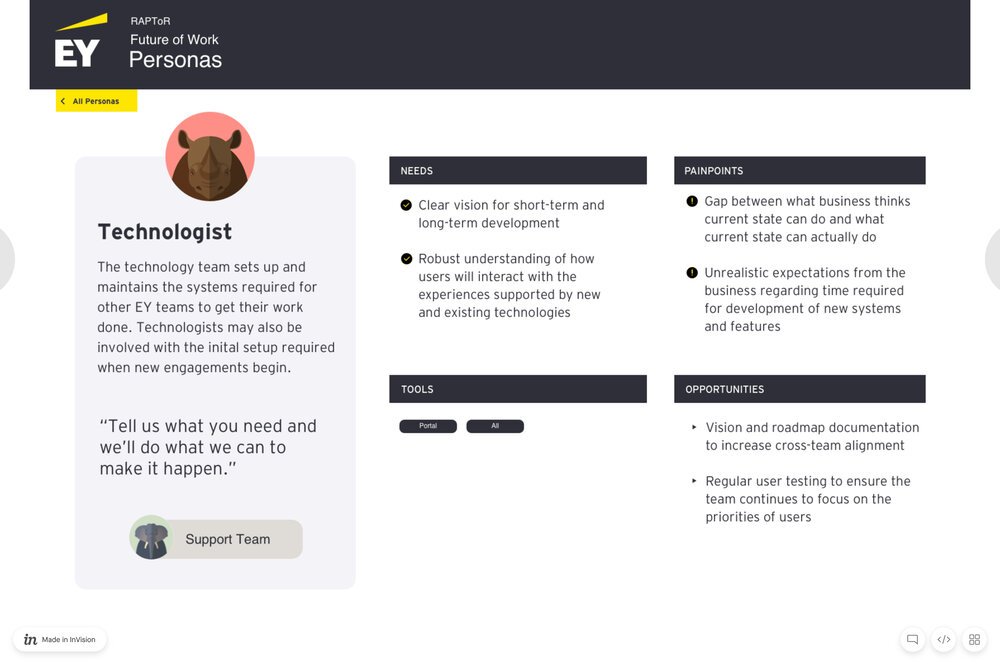

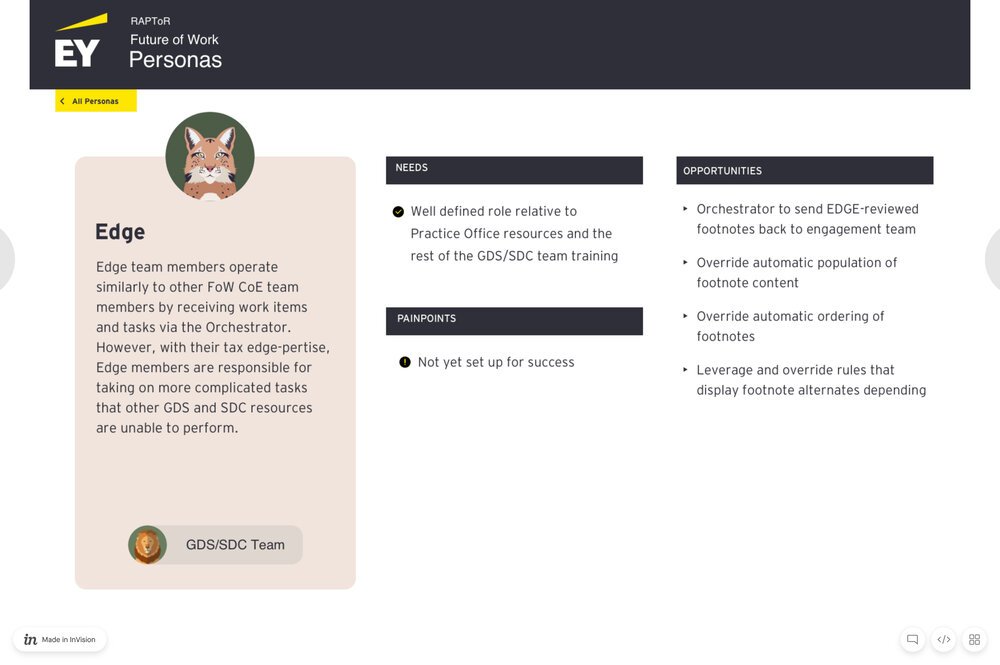

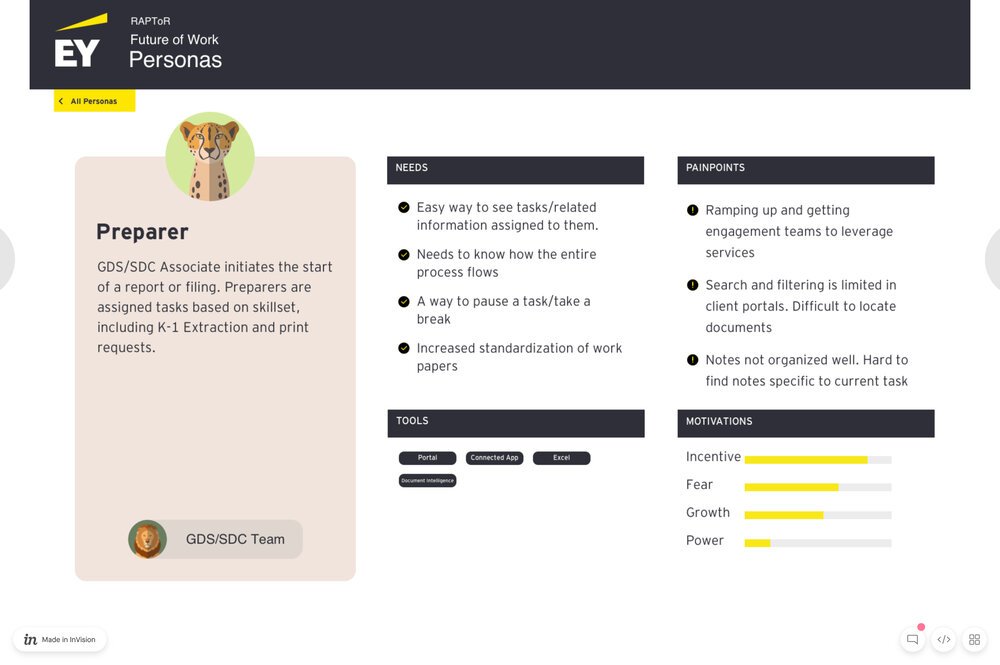

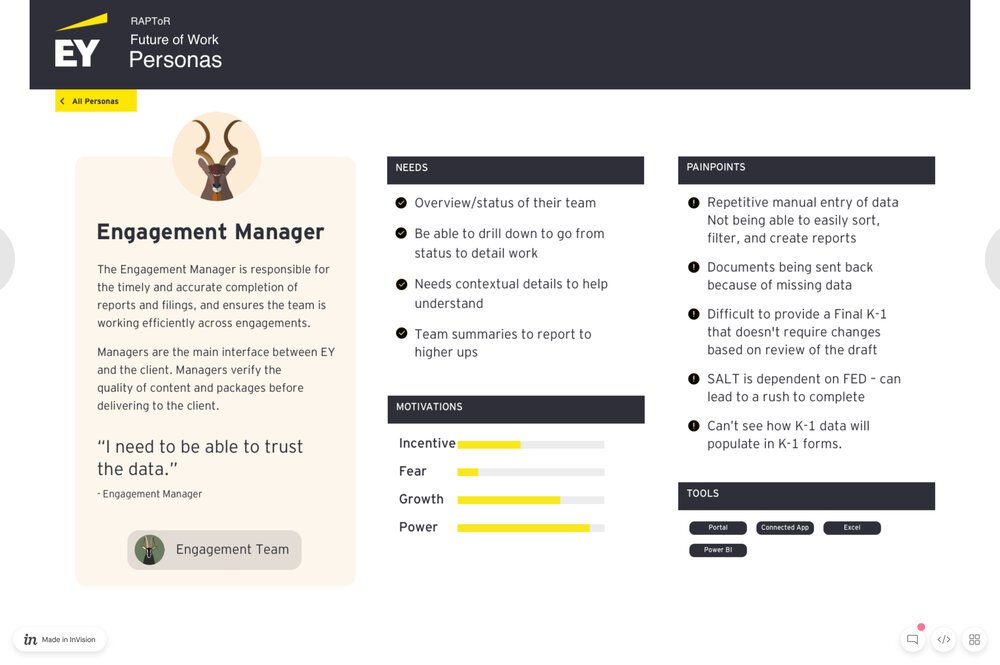

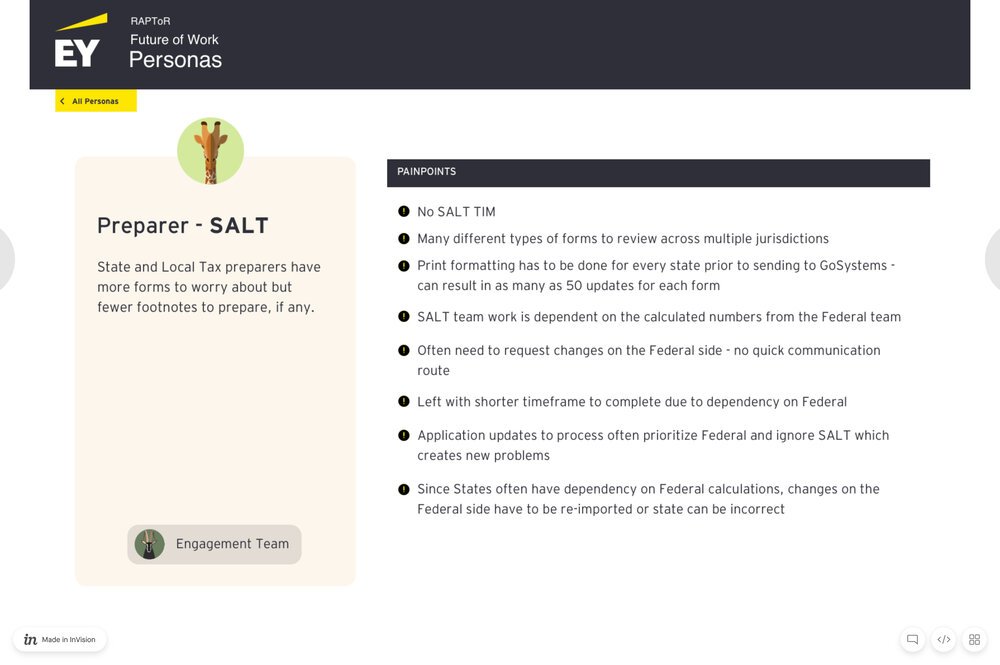

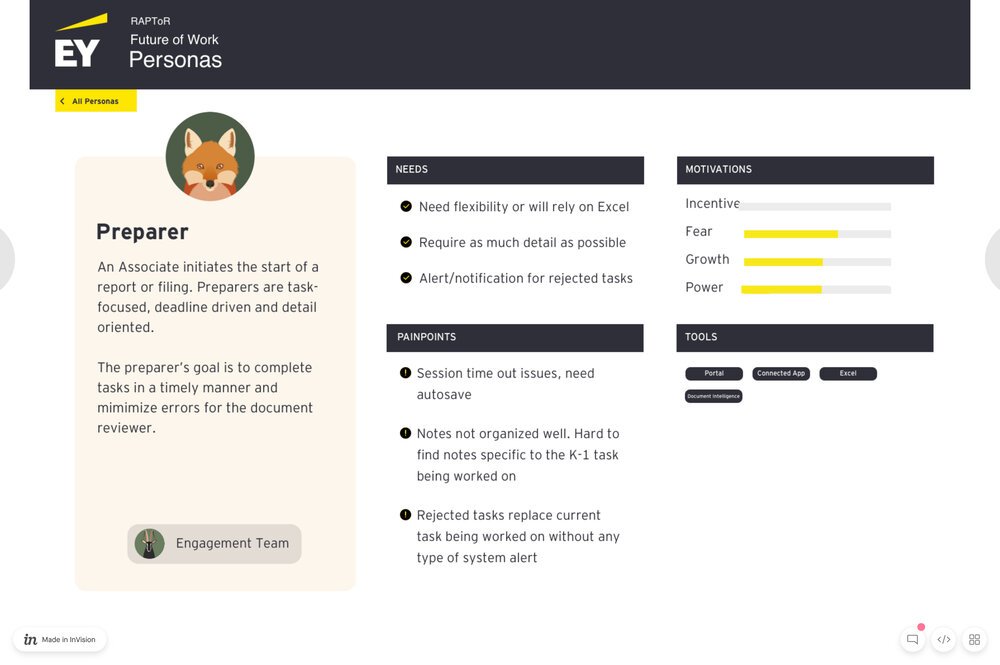

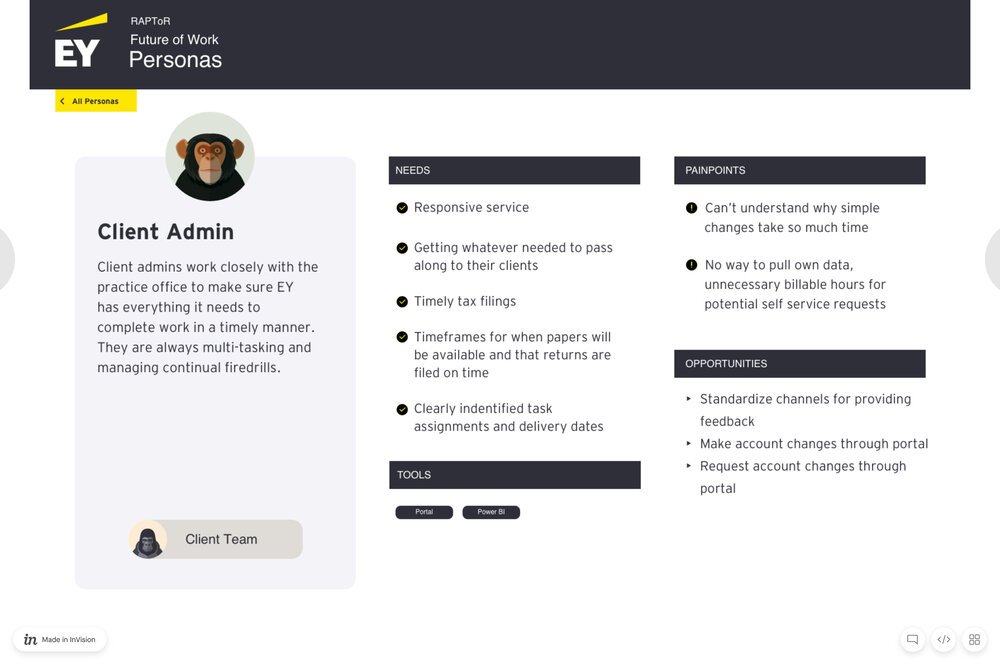

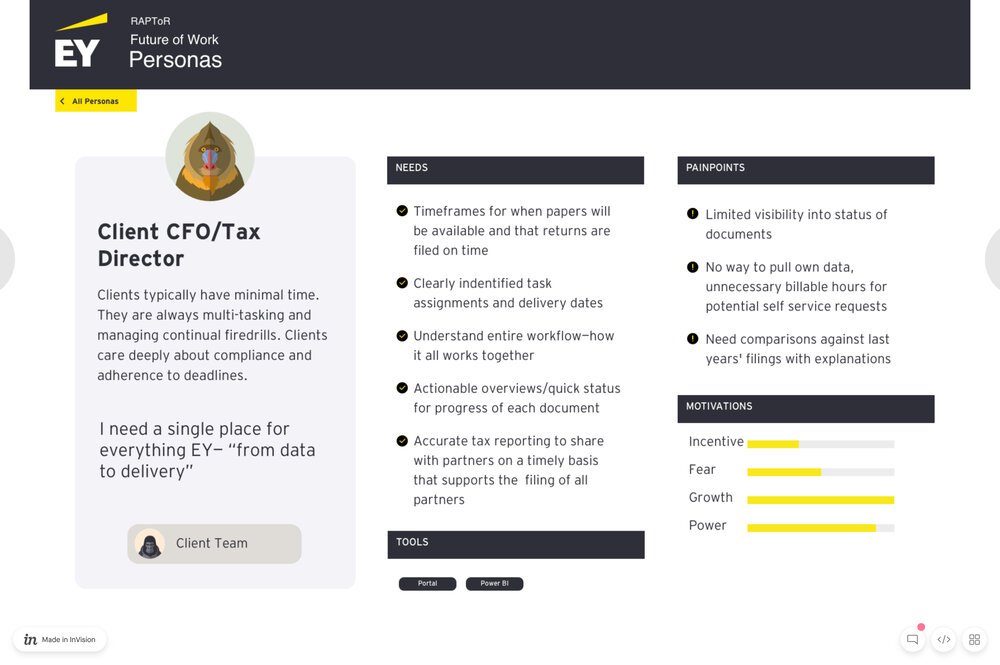

Personas / Team Structure

Requirements Gathering for TIM

User flow - CAM

UX/UI Audit

Designed over 100+ wireframes (low and hi-fidelity) for many workspaces, including Taxable Income Module (TIM), Charted Accounts Module (CAM), User Management (UM for client on-boarding), Investment Tracker, Dashboard, and many more internal apps. Below are only onboarding screens for CAM.

Investment Tracker

User Behaviours in summary

Multi-Role Access & Personalization

Users include corporate tax teams, internal EY consultants, and external clients who require different data visibility and interaction levels. Role-based dashboards dynamically display relevant tasks, KPIs, and document statuses, supporting quicker decision-making across stakeholder types.

End-to-End Tax Lifecycle Management

Users manage the complete lifecycle of tax obligations—from document intake, data verification, and processing, to final submission. Integrated task automation reduces manual entry and streamlines the review process, resulting in an estimated 25–30% increase in operational efficiency.

Cross-Team Collaboration & Compliance Assurance

Users rely on built-in collaboration tools such as document annotation, notifications, and access logs to ensure transparency and compliance. Cross-functional users across global time zones use shared dashboards and progress tracking to meet deadlines and maintain audit trails.

Data Visualization & Strategic Reporting

Senior users use dynamic data visualizations and automated reporting features to identify risk exposure, track jurisdiction-specific filing requirements, and ensure global alignment. Reports are tailored by region, contributor, or deadline, and downloaded or exported for board-level visibility.

Scalable System Architecture

Users expect performance consistency across high-volume enterprise activity. The platform supports global tax teams with a scalable cloud architecture that accommodates large uploads, simultaneous editing, and real-time status updates, ensuring minimal downtime and high user trust.

What I accomplished:

1.

Defined the strategic foundation of EY’s financial SaaS platform, aligning UX vision with business objectives by collaborating with UX strategists, stakeholders, and product leaders. Led end-to-end design execution, effectively communicating design rationale and outcomes to drive stakeholder alignment and ensure the highest-quality implementation.

2.

Designed and optimized complex financial modules, delivering 100+ high-impact wireframes (low and high fidelity) across key workspaces, including Taxable Income Module (TIM), Chart of Accounts Module (CAM), User Management (client onboarding), Investment Tracker, and Dashboard. Ensured scalability, accessibility, and compliance with EY’s enterprise design standards, enhancing operational efficiency and user adoption.

3.

Drove cross-functional collaboration by actively participating in requirements gathering, user flow development, and stakeholder workshops. Worked closely with international engineering teams to translate complex financial workflows into intuitive digital experiences, optimizing usability and increasing platform adoption across global markets.